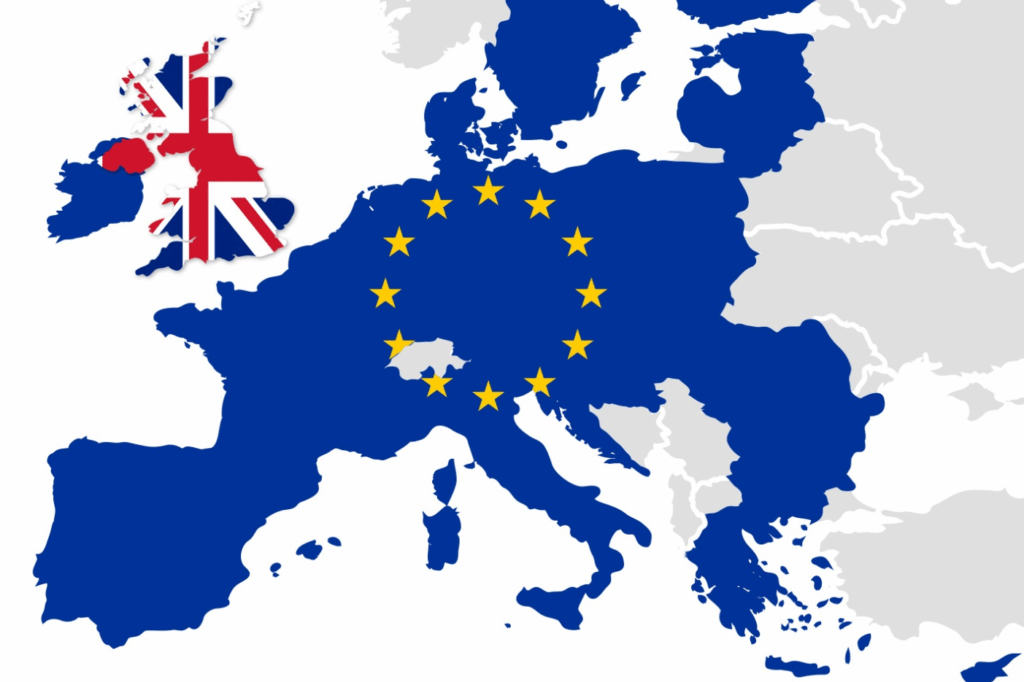

A New Chapter in EU-UK Relations: Strategic Alliances, Economic Ties, and Shared Global Goals

The European Union and the United Kingdom have taken a decisive step toward revitalizing their relationship, marking a significant post-Brexit shift in diplomacy, cooperation, and mutual strategic interest. At the […]